|

18

magis

|

february 2014

Inclusive

Finance

For

Excluded

poor

I

f fradulent

microfinance

companies are the market’s problem

child then financial inclusion of poor

could be the much needed solution of

the hour.

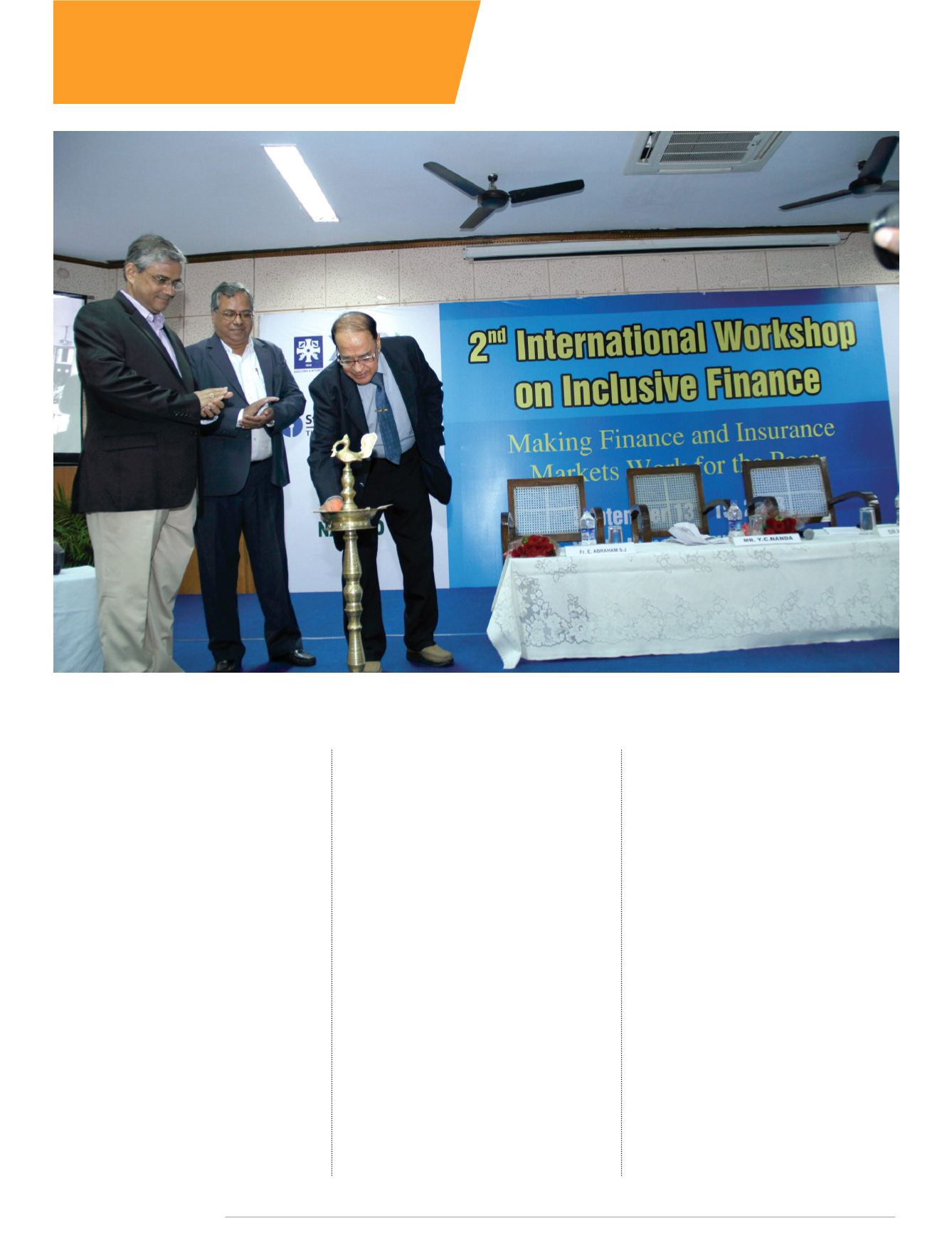

Making this neglected concern the cen-

ter of discussion at the International Work-

shop on Inclusive Finance XLRI attempts

to generate rich ideas for the poor.

The three-day workshop brought

together academics, practitioners, micro-fi-

nance institutions and NGOs to brainstorm

on Making Finance and Insurance Markets

Work for the Poor. The focus of the meet

was to find ways to make finance reach the

poorest of the poor and prevent fraud chit

funds from milking the needy.

At the inaugural session, Chairperson

of National Commission on Farmers YC

Nanda said, “Reaching financial services to

all the sectors, particularly agriculture and

rural areas, has been a major concern for

the policy makers for long.”

“The development of an elaborate

co-operative banking system — with over

a hundred thousand primary coopera-

tive societies at the village level — social

control and later, nationalisation of banks,

establishment of nearly 300 regional

rural banks, tremendous expansion in the

number of rural branches, setting priority

sector targets with sub-targets for agricul-

ture credit, direct agriculture credit, loans

to weaker sections were all part of state-led

approach with focus on access to credit,”

he pointed out.

Nanda added, “Results have been mixed.

There is still a strong possibility that the

financial system may reach a level of inclu-

sion in none too distant future which would

be adequate for the immediate purpose of

introducing DBT (Direct Benefit Transfer)

in the country.”

XLRI director Fr E Abraham S.J. said,

“Access to finance should be universal;

in today’s modernised economy, this has

Knowledge Works

The focus of the meet

was to find ways to

make finance reach

the needy and prevent

fraud chit funds from

milking them

Chairperson of National Commission on Farmers YC Nanda lights the inaugural lamp

while Director, XLRI, Fr E Abraham S.J. (Centre) and Prof HK Pradhan look on